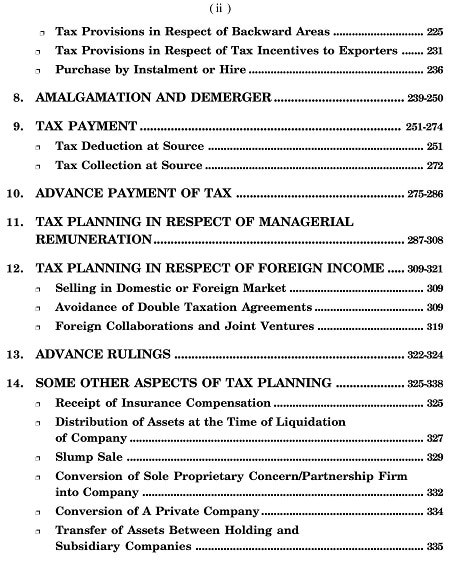

Corporate Tax Planning And Management Pdf

Project Planning And Management

Corporate Tax Planning And Management In Hindi Pdf

Let’s talk about tax saving expenses. We end up paying tax on various expenses which are otherwise eligible for tax benefits that we fail to grasp due to ignorance about them. Read on to understand some such expenses where you can save tax.

Download corporate tax management and planning PDF Online. Browse more videos. Playing next. PDF Corporate Tax Planning Theory and Practice (2nd Edition) (Chinese Edition) Ebook Online. 0:21 Download software companies and high-tech corporate tax planning guide Paperback Free.

Medical expenses of disabled dependent: For a dependent person in your family who has a disability, there is tax benefit under section 80DD. This tax deduction is a social support for disabled family member from the government, so as to ease that person’s dependence on you. This means a saving of up to Rs 1,25,000 on the taxable income.

Expenses for a disabled individual: Same as section 80DD deductions. A person who has disability gets benefit through section 80U. Maximum deduction is INR1,25,000.

Treatment of specified diseases:

- Treatment of diseases like cancer and AIDS is very expensive and Section 80DDB offers the much needed financial relief to the person suffering from such ailment and his family members.

Charitable donations:

There is another reason to rejoice when you make donations. Besides supplementing your good deeds, you also gather the right to claim another tax exemption covered under section 80G.

Please help us create a positive place to interact by being pleasant to everybody here. Agents of mayhem characters. We want this subreddit to be fun and fulfilling for the people posting here.

There is an upper limit on cash donations. Such donations are capped at Rs 2,000.

Donations for scientific research or rural development:

Donations towards scientific research are open for deduction through section 80GGA.

There are some other situations too where you get to save tax.